riverside county tax collector mobile home

The Riverside County Tax Collector is a state mandated function that is governed by the California Revenue Taxation Code Government Code and. All tax bills paid online or by the automated phone system are due by midnight on the delinquent date.

7 Powerful Benefits To Mobile Home Park Investing

There are 3 Treasurer Tax Collector Offices in Riverside County California serving a population of 2355002 people in an area of 7205 square miles.

. The Assessors primary responsibility is to value taxable property. The median property tax in Riverside County California is 2618 per year for a home worth the median value of 325300. Welcome to the Riverside County Property Tax Portal.

Riverside County collects on. The Tax Collectors office is responsible for the collection of property taxes. Riverside County Treasurer Attn.

Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. Riverside County Assessor-County Clerk-Recorder Office Hours Locations Phone. The Assessor must determine a value for all taxable property and apply all legal exemptions and exclusions.

The Assessor locates all taxable property in. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties. Please be advised that if for any reason you are unable to make your tax payment in an automated fashion over the phone or web you are still.

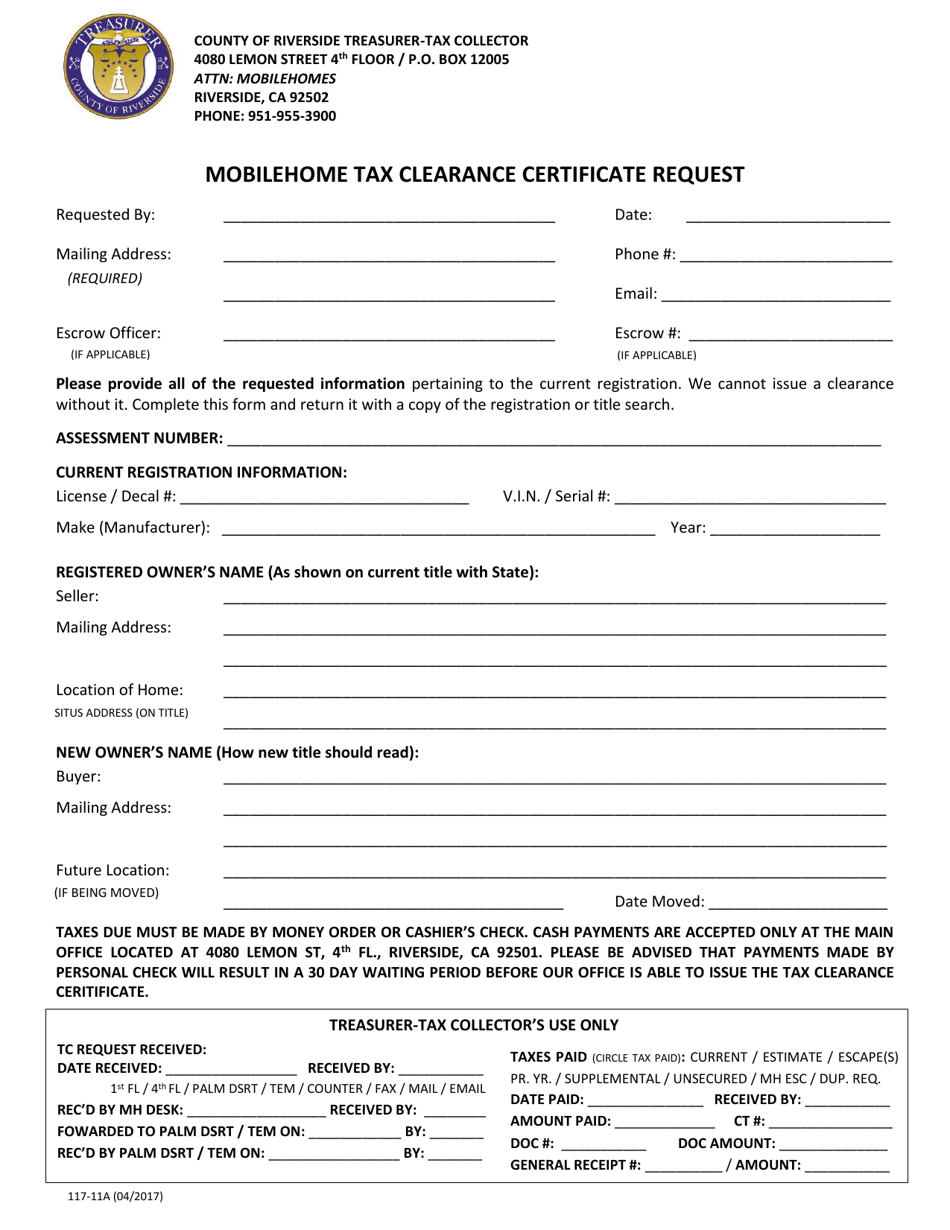

Temecula Wine Country Tourism. Welcome to Riverside County Assessor Online Services. Mobilehome Tax Clearance Certificates.

The Riverside County Treasurer - Tax Collector is proud to offer online payment services. Following receipt of this information the Tax Collector performs a search of the tax rolls to. If the mobilehome is currently registered within Riverside County Click HERE to find your.

The offices of the Assessor Treasurer-Tax Collector Auditor-Controller and Clerk of the Board have prepared this site to introduce. Box 12005 Riverside CA 92502-2205. Riverside County CA currently has 2727 tax liens available as of January 21.

951 955-6200 Live Agents from 8 am - 5 pm M-F Click Here to Contact Us. Welcome to the County of Riverside Assessor Online Services. Should you wish to contact the Tax Office concerning this matter please telephone 951 955-3900.

Riverside CA 92502 USA. They are maintained by. Property taxes are collected by the county although they are governed by California State LawThe Tax Collector of Riverside County collects taxes on behalf of the following entities.

The Riverside County Tax Collector is a state mandated function that is governed by the California Revenue Taxation Code Government Code and the Code of Civil Procedures. Many mobile-homes originally built and sold before June 30 1980 are on the in-lieu tax system administered by the State Department of Housing and Community Development HCD. Yearly median tax in Riverside County.

Property Tax Postponement The program allows homeowners who are seniors are blind or have a disability. OFFICE OF THE TREASURER-TAX COLLECTOR. Mobile Home Rentals Riverside Ca.

Tax Cycle Calendar and Important Dates to Remember.

Non Receipt Of Title To Mobile Home Ksfg Scm Mobile Home Parks

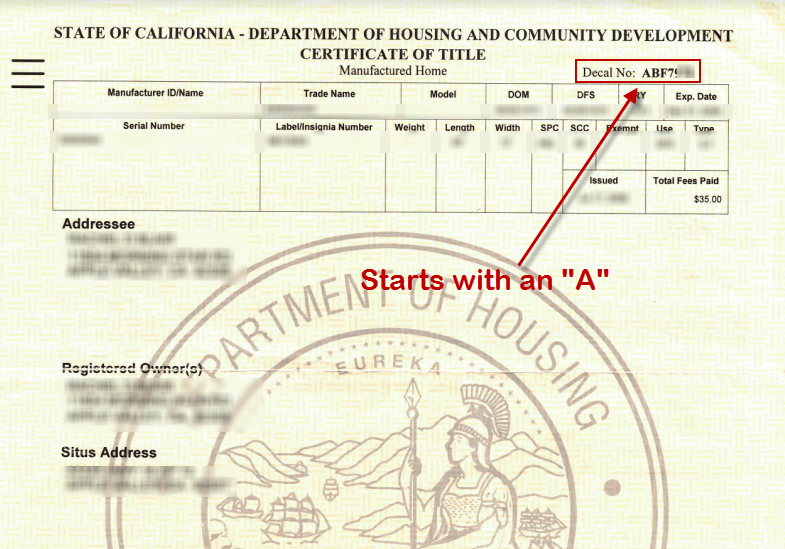

How To Transfer A Mobile Home Title In California Mobile Home Investing

Lost Mobile Home Titles Other Common Title Issues Mobile Home Investing

California Mhp News Jan 2017 Mobile Home Park Home Owners Allegiance Mhphoa

Clayton Homes Of Liberty Modular Manufactured Mobile Homes For Sale

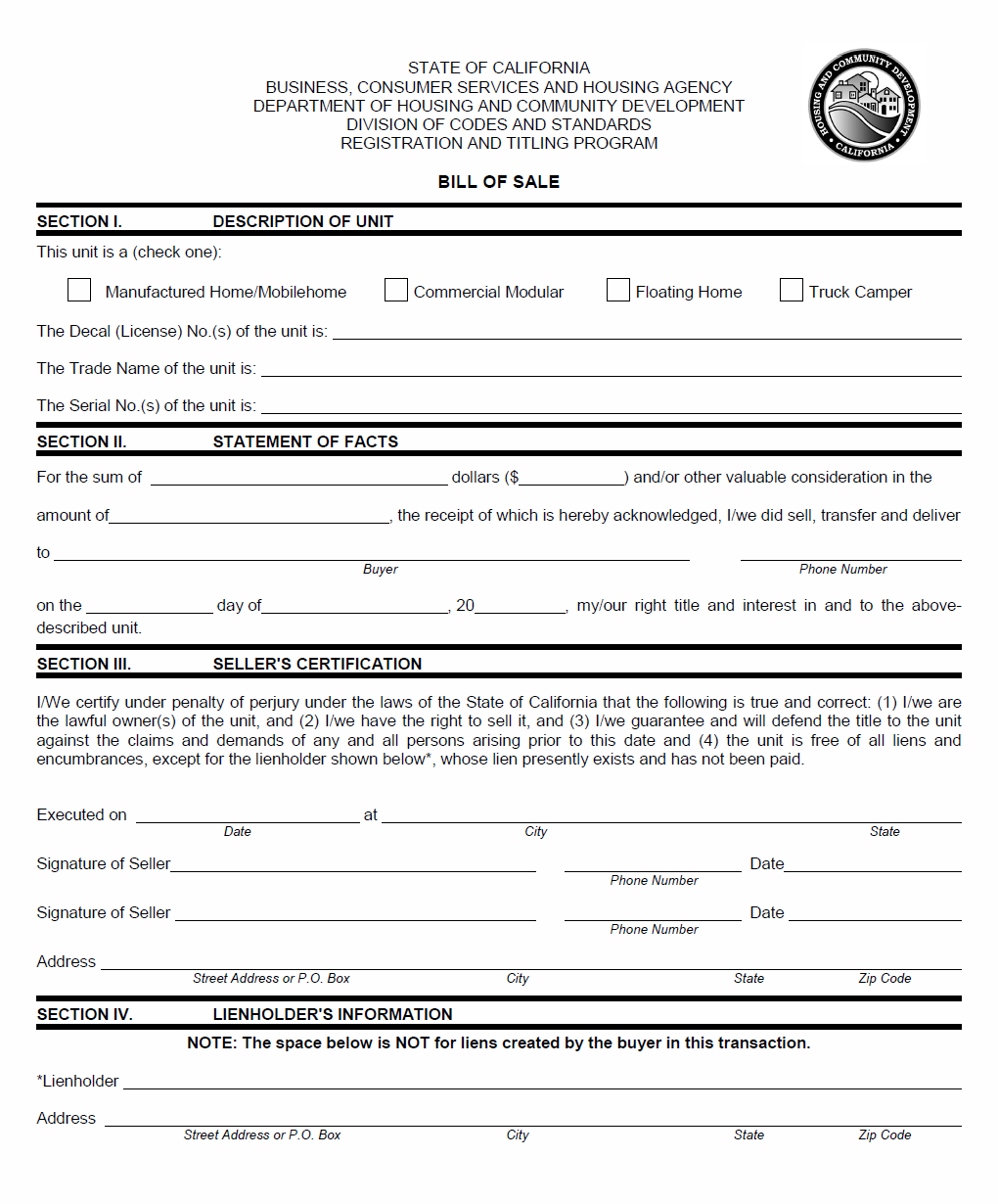

Form 117 11a Download Fillable Pdf Or Fill Online Mobilehome Tax Clearance Certificate Request Riverside County California Templateroller

How To Transfer A Mobile Home Title In California Mobile Home Investing

California Mhp News Jan 2017 Mobile Home Park Home Owners Allegiance Mhphoa