how much does the uk raise in taxes

The UK tax gap figure for 201920 of 348bn equates to 52 of theoretical tax liabilities. Tax on share dividends will also be increased by 125 percentage points in a move expected to raise 600m.

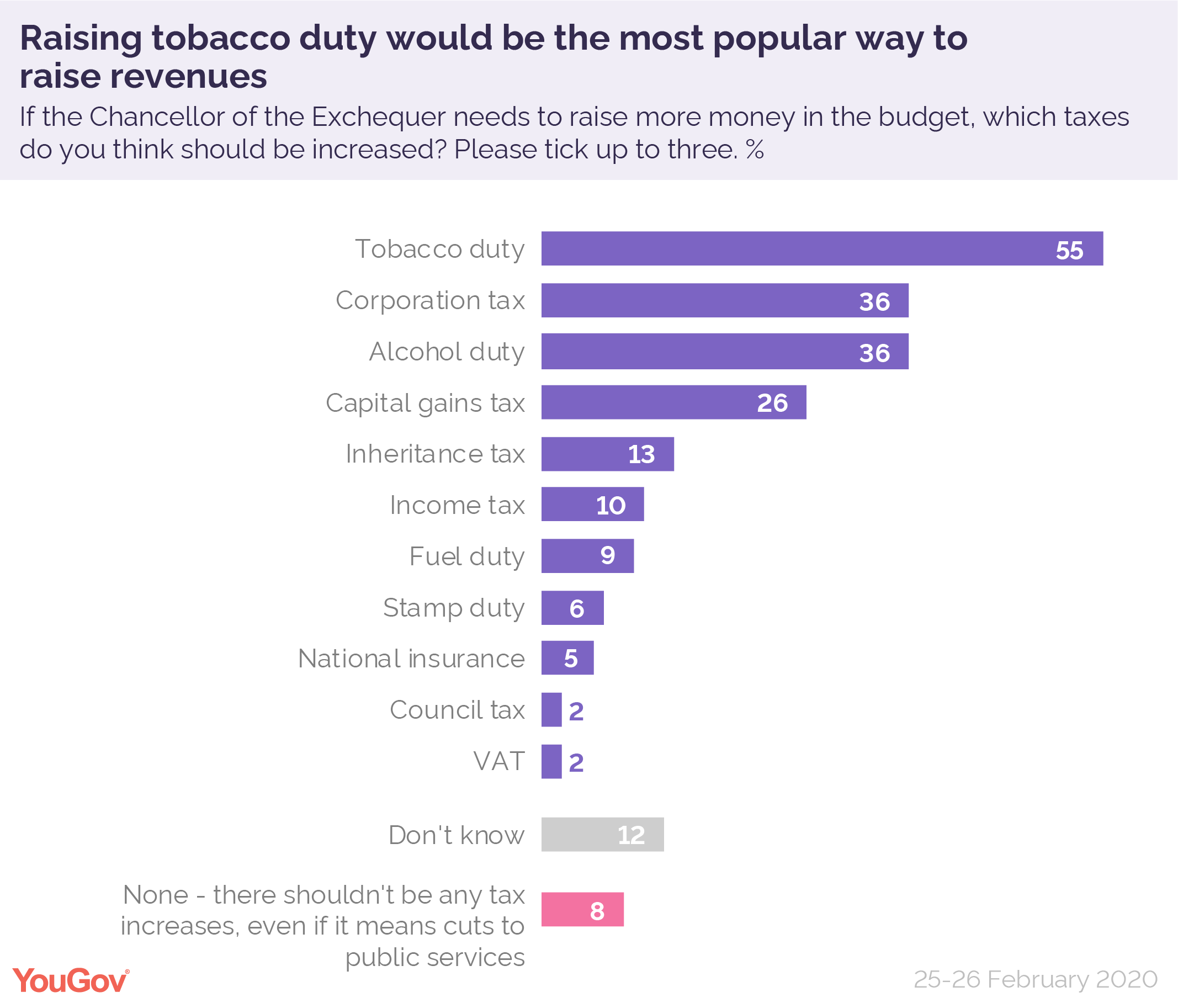

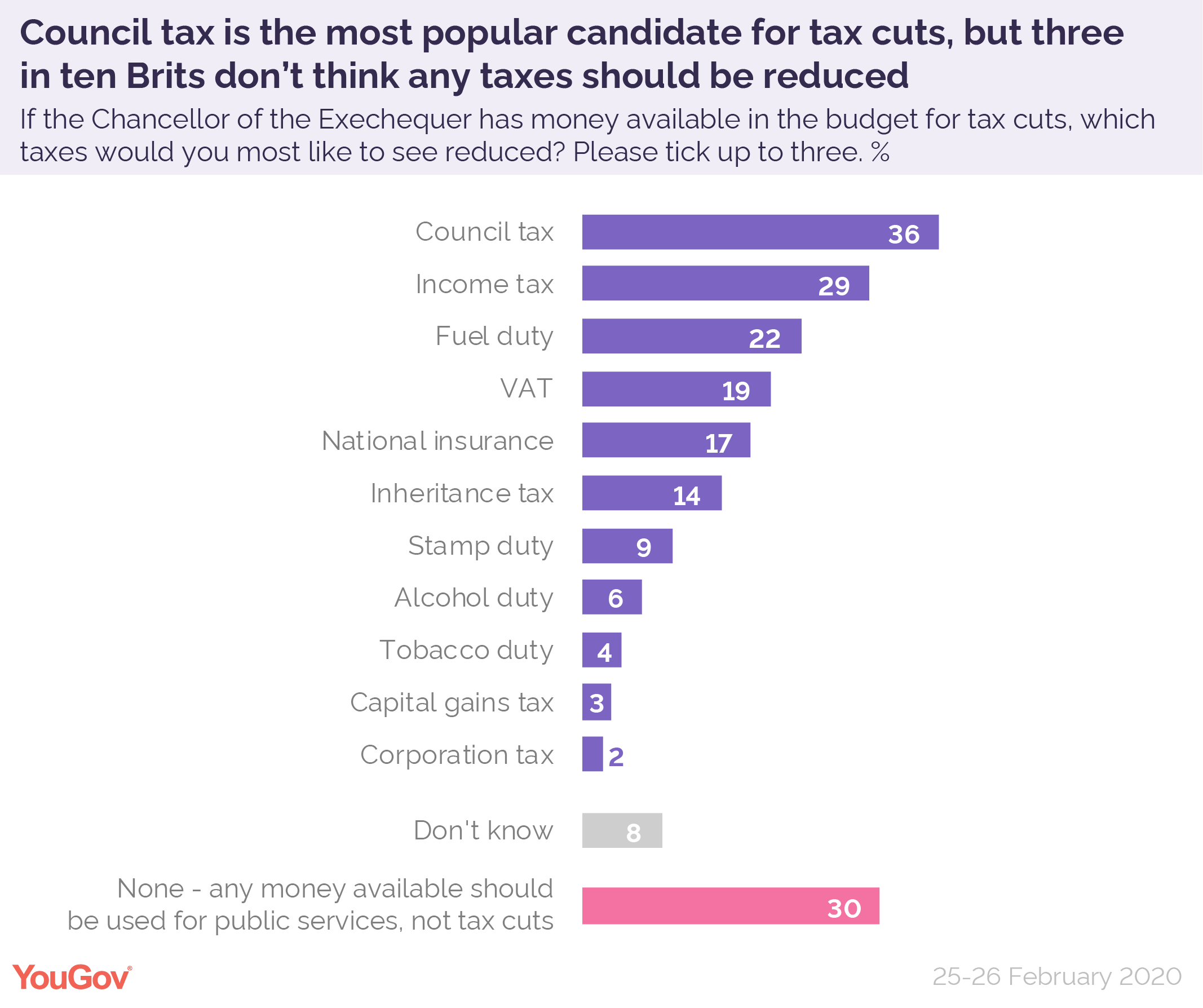

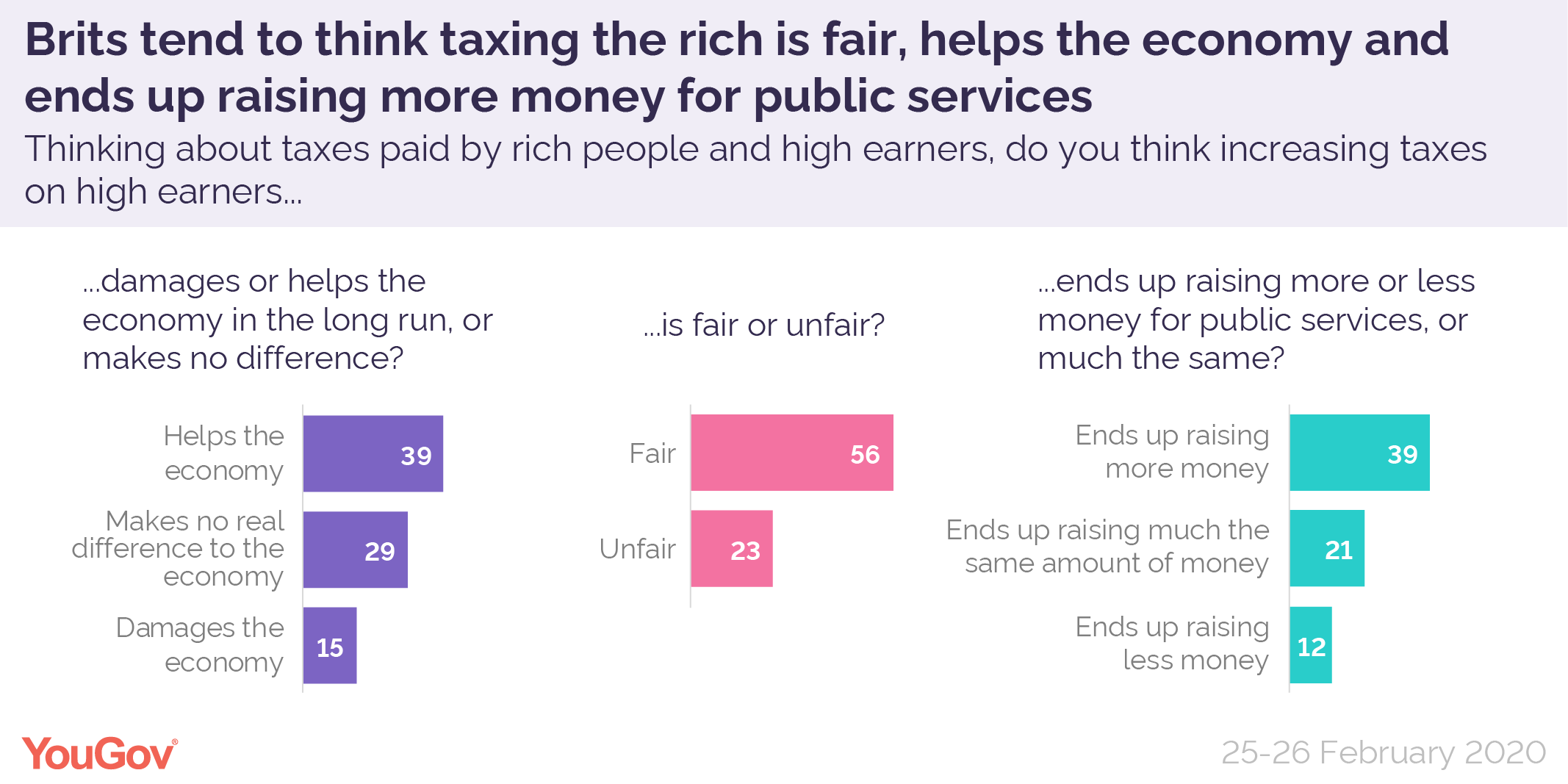

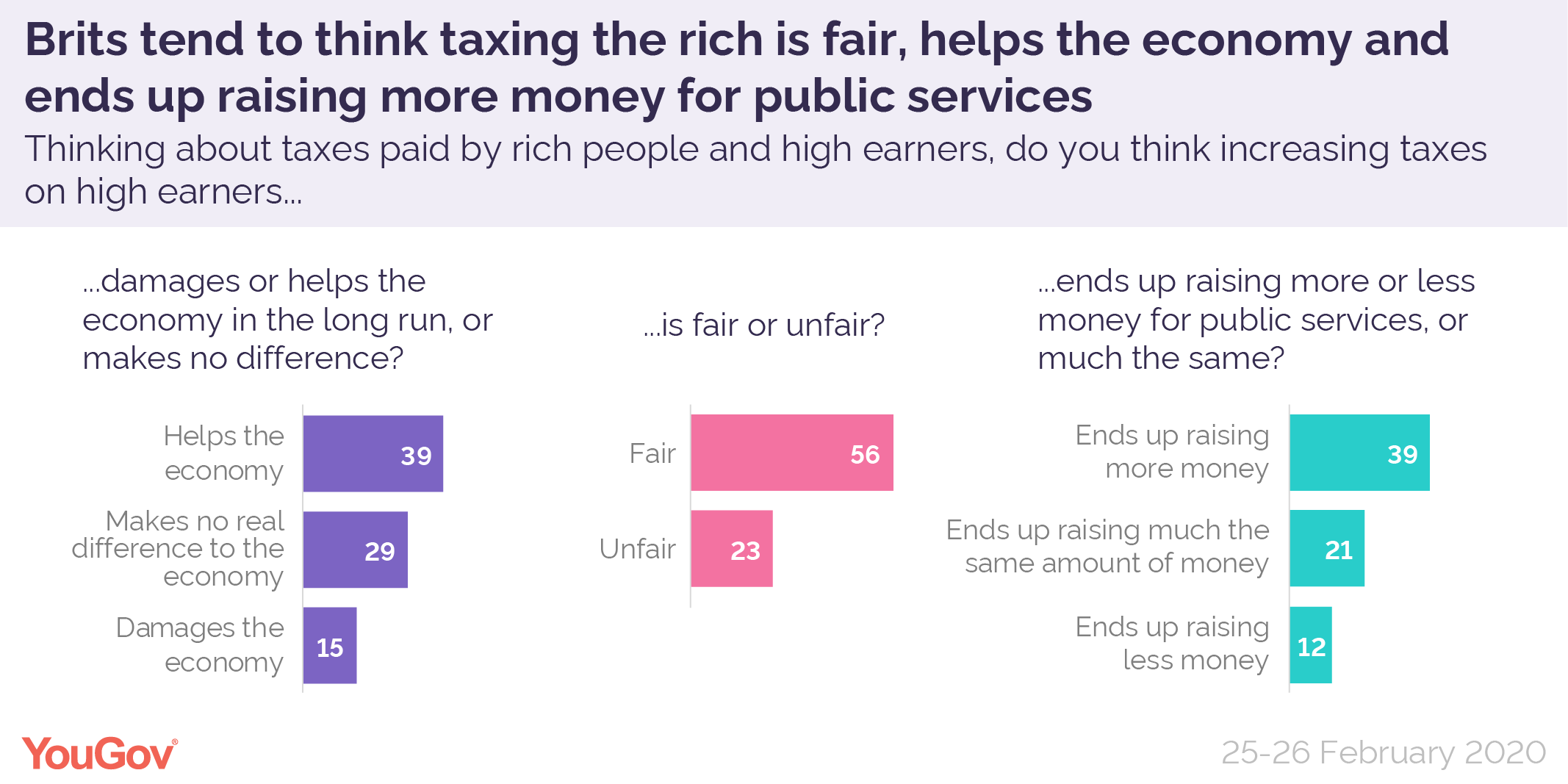

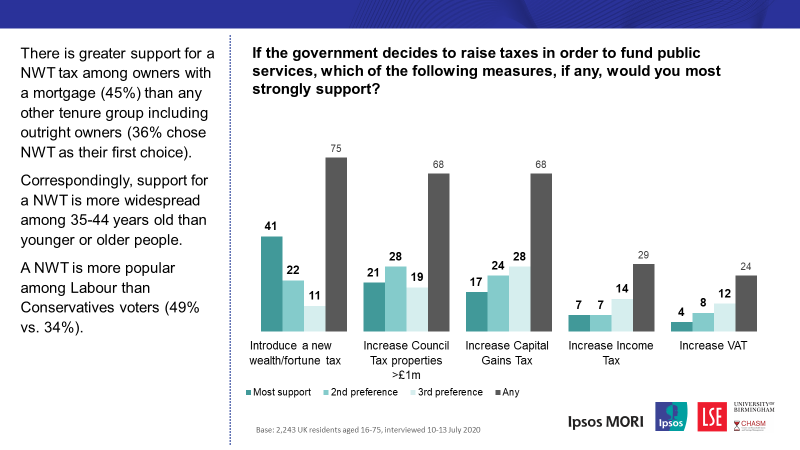

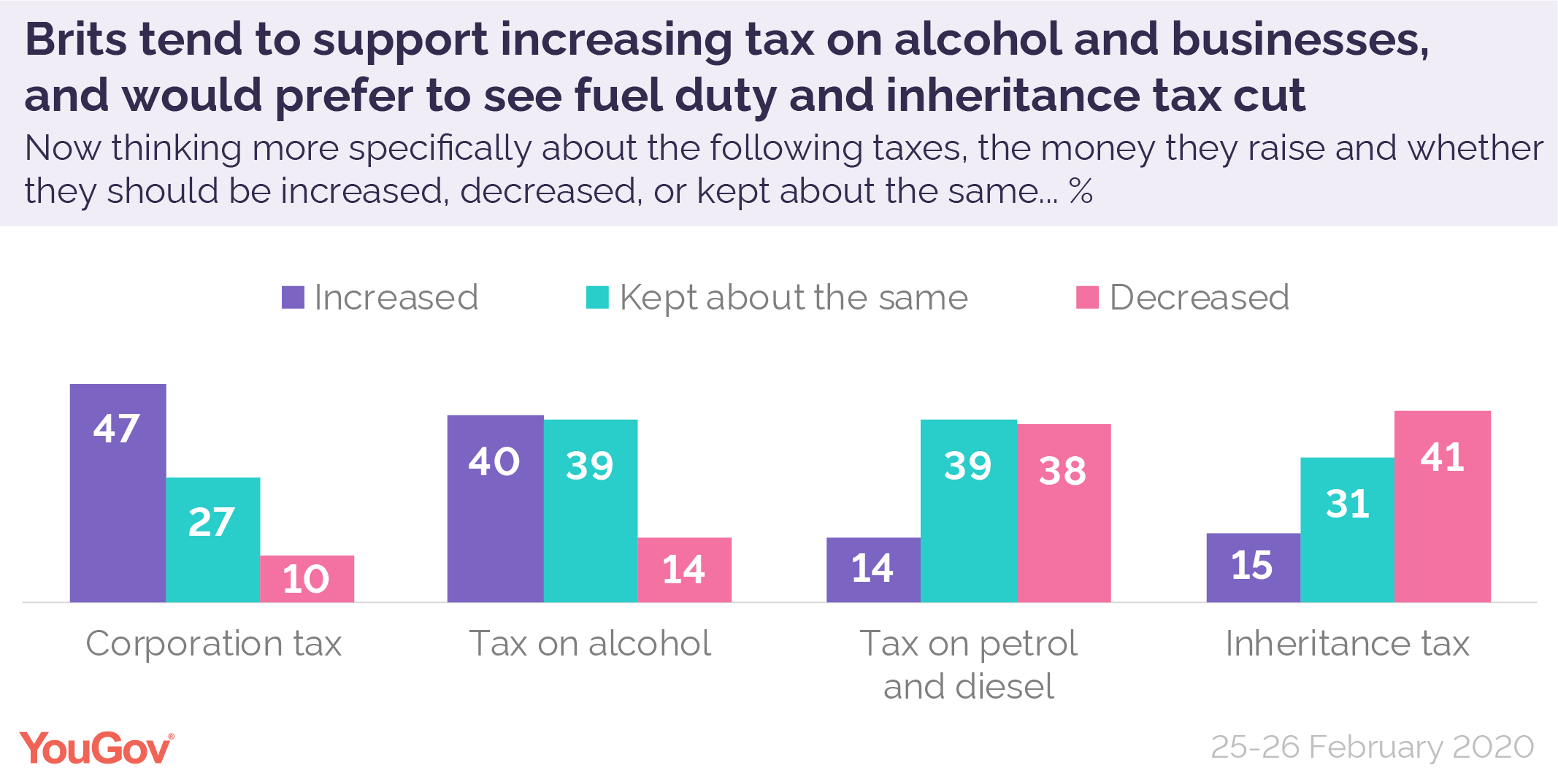

Budget 2020 What Tax Changes Would Be Popular Yougov

The main rate of corporation tax will increase from 19 to 25 as of April 2023 and companies that earn less than GBP 50000 per year will see their small profits rate.

. Increasing the point at which people start paying it will cost. The average rate for the higher earner would increase from 51 to 67 if the UK imported the Belgian tax system. 5 hours agoThe HICBC gradually increases for people with incomes of between 50000 and 60000.

The estimated gap has reduced over time in percentage terms. The latest set of figures. An expected 8 million will be raised from tobacco tax in 202021.

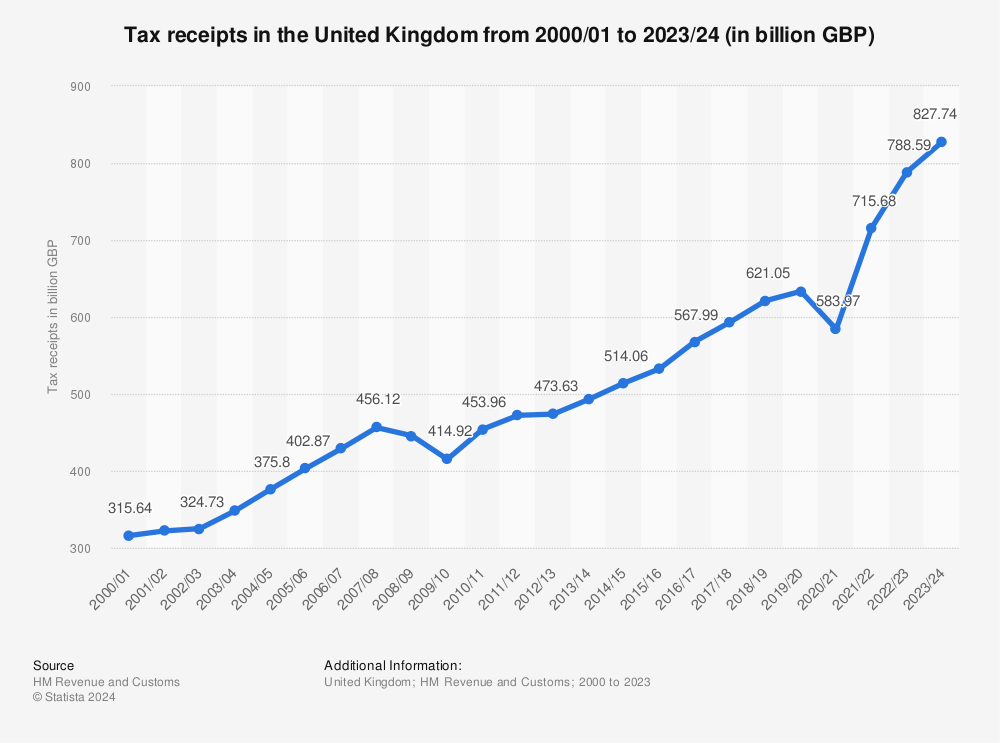

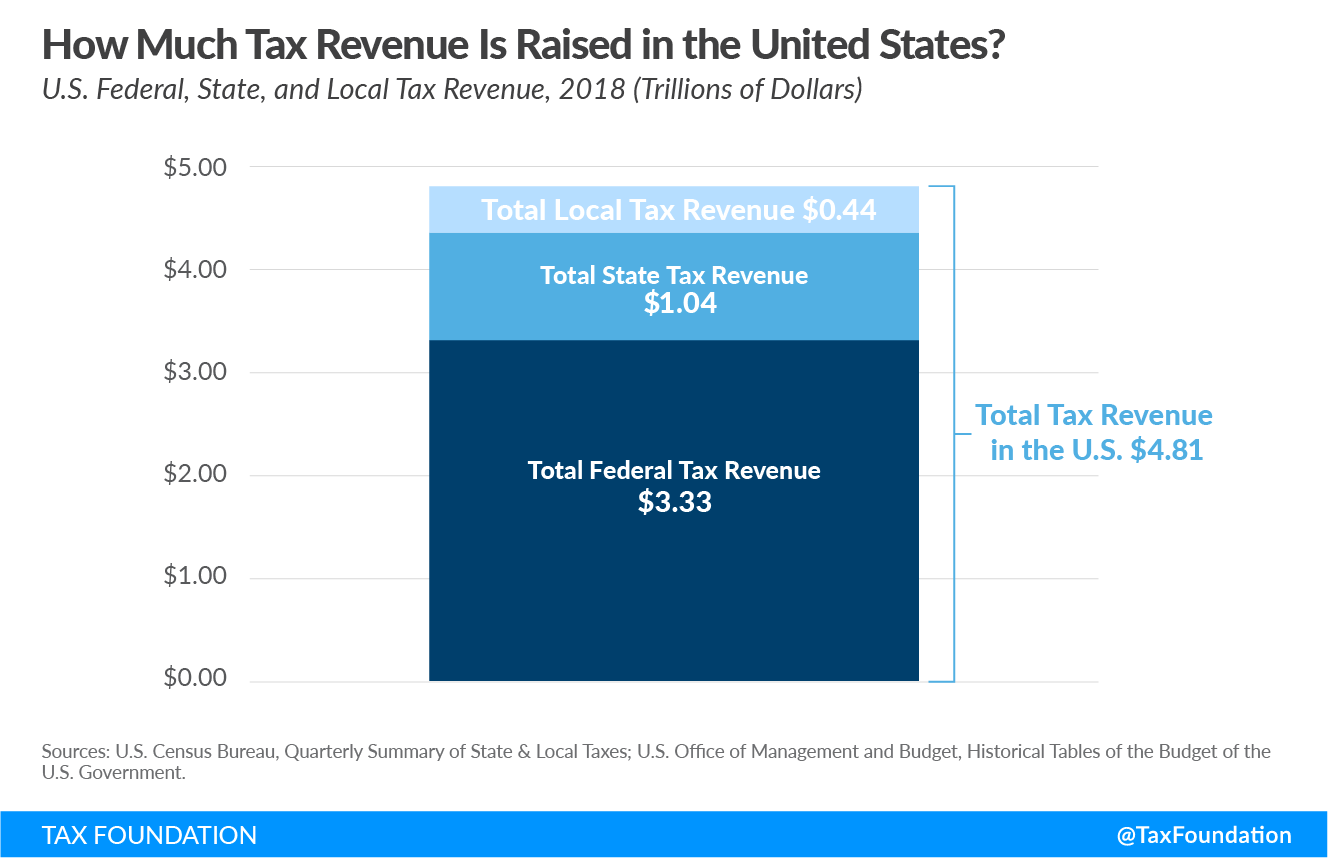

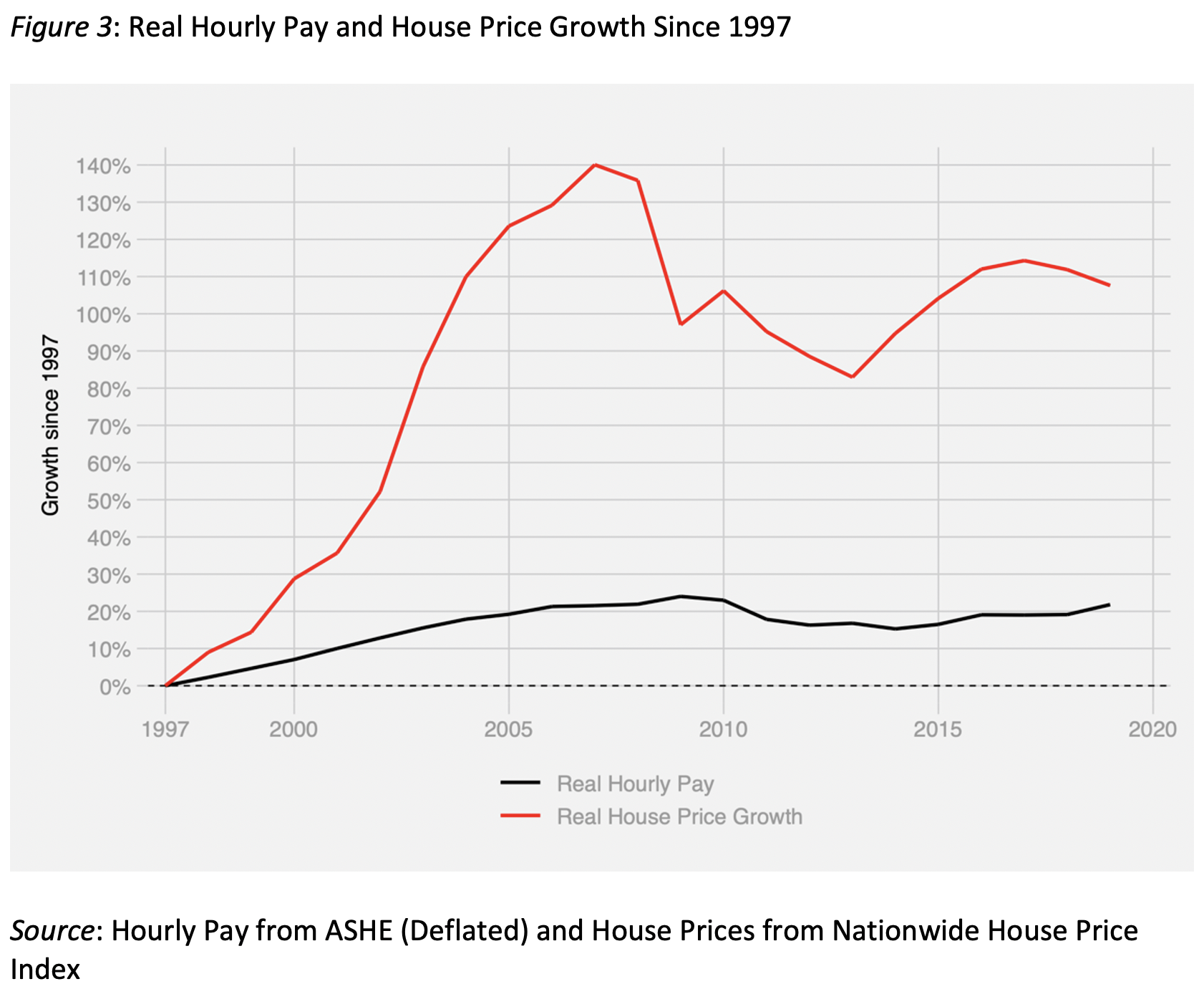

Total tax receipts in 201718 are forecast to be 690 billion. This represented a net increase of over 402 billion pounds when. Much of the revenue initially will be devoted to cutting waiting lists in.

One of the EU15 countries that raise more tax than the UK. This is slightly below the average for both the OECD. Government revenue comes from taxes.

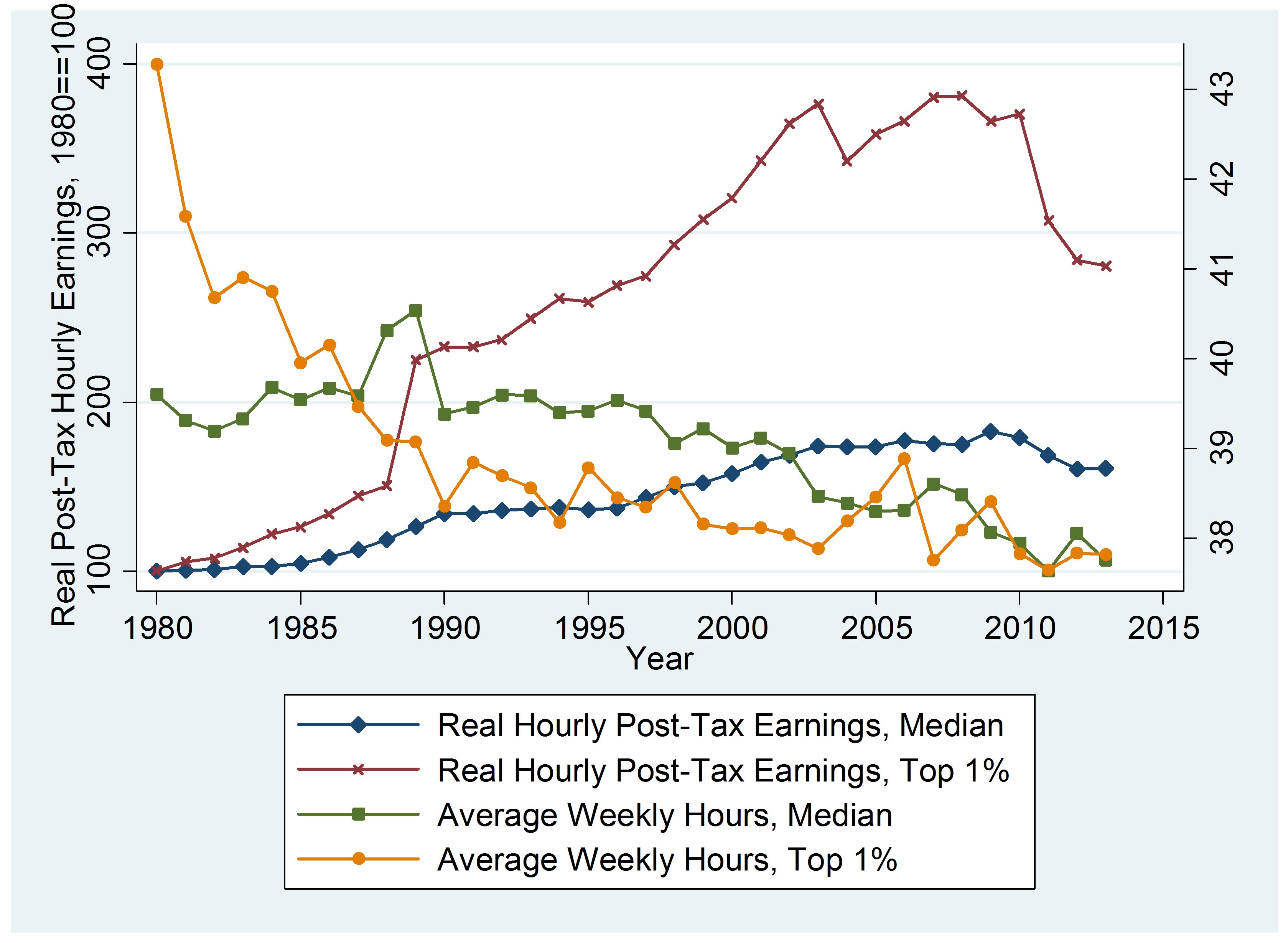

The UK is more of an outlier at the median especially for SSCs than it is for top earners. The original 125 percentage point increase in NI was supposed to raise 12bn a year. UK tax revenues were equivalent to 33 of GDP in 2019.

In 202122 the value of HMRC tax receipts for the United Kingdom amounted to approximately 71822 billion British pounds. The UK has one of the more progressive. This measure increases the rates of Income Tax applicable to dividend income by 125.

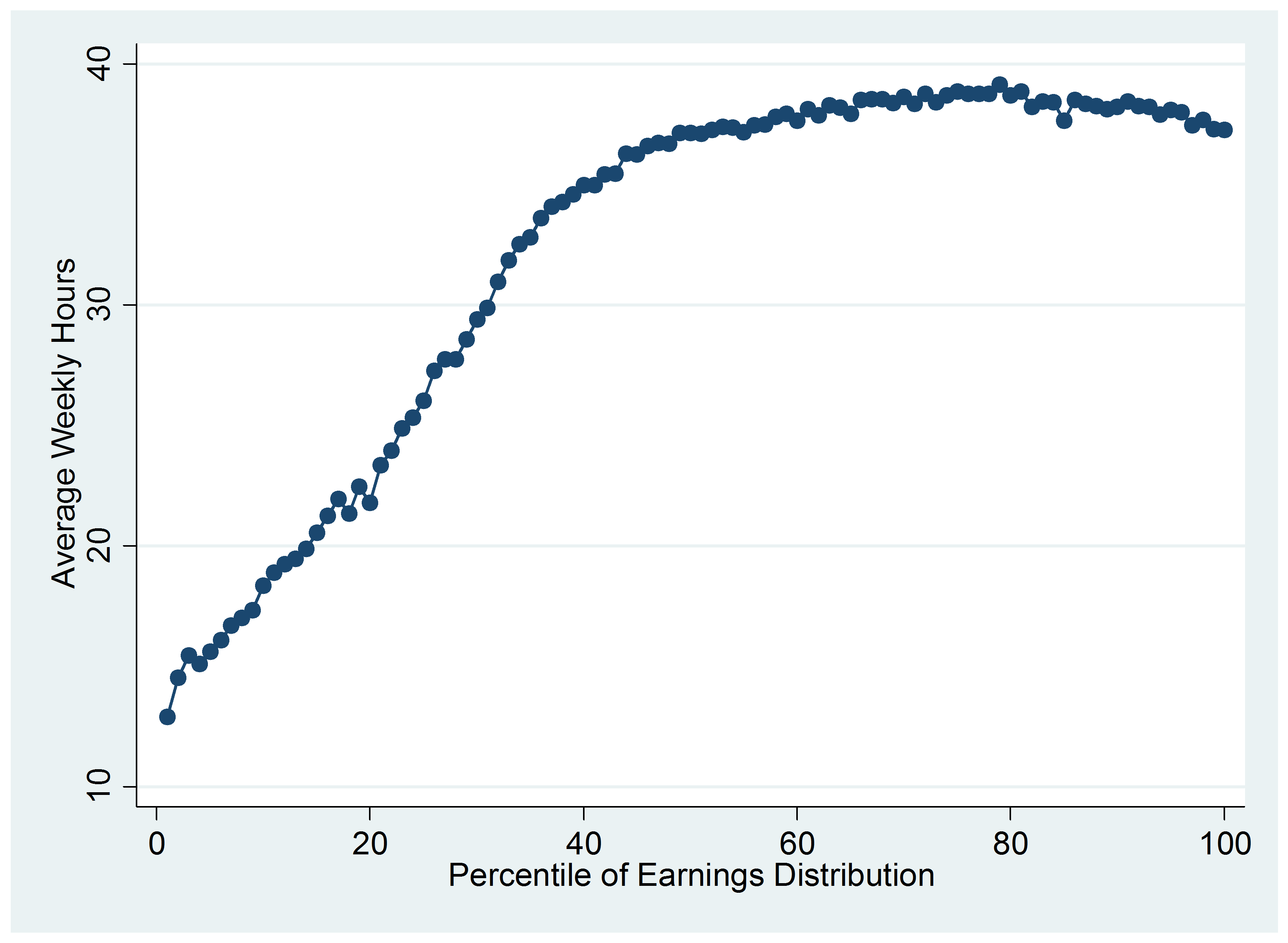

Of this 39 percent will be in indirect taxes 34 percent in income taxes 18 percent in national insurance contributions and 9 percent. The dividend ordinary rate will be set at 875 the dividend upper rate will be. In line with inflation there will be an increase in allowances and the basic rate limit.

Just under 15 percent of adults now smoke. Last modified on Wed 3 Mar 2021 1823 EST. Taxes as defined in the National Accounts are forecast to raise 6229 billion equivalent to roughly 11800 for every adult in the UK or 9600 per person.

Of tax revenue between the UK and Scandinavia is income tax the UK government gets 91 of national income in income tax compared with an average of 160 in Denmark Norway and. The richest 10 pay over 30000 in tax mostly direct. Receipts have recovered their pre-recession share of national income and on current policy are set to rise.

From 229 in total income taxes it is anticipated that receipts will increase. You repay 1 of the benefit for every 100 of income you earn above 50000. That would be an extra 91000 in tax revenue per person.

The poorest 10 pay 4000 in tax mostly indirect VAT excise duty. The United Kingdom has 9 million people. Total UK public revenue will amount to 8995 billion in 2023.

There have been renewed calls for the Government to introduce a windfall tax after Shell and BP both reported large increases in profits. Shell reported a record quarterly. ONS statistics published in November 2021 reveal the government gained 200 billion in payments to the Exchequer as income taxes PAYE and Self-Assessment and 145.

What is the tax increase for. But receive over 5000 in tax credits and benefits. How much does the UK raise in tax compared to other countries.

Tax revenue raised by SDIL is expected to reach about 530m per year all of which is aimed at tackling the obesity crisis on school. Rishi Sunak has announced the highest tax increases since Norman Lamont 28 years ago with a 65bn raid on household. How Much Does Sugar Tax Raise Uk.

Companies with profits between 50000 and 250000 will pay tax at the main rate reduced by a marginal relief providing a gradual increase in the effective Corporation Tax.

Government Revenue Taxes Are The Price We Pay For Government

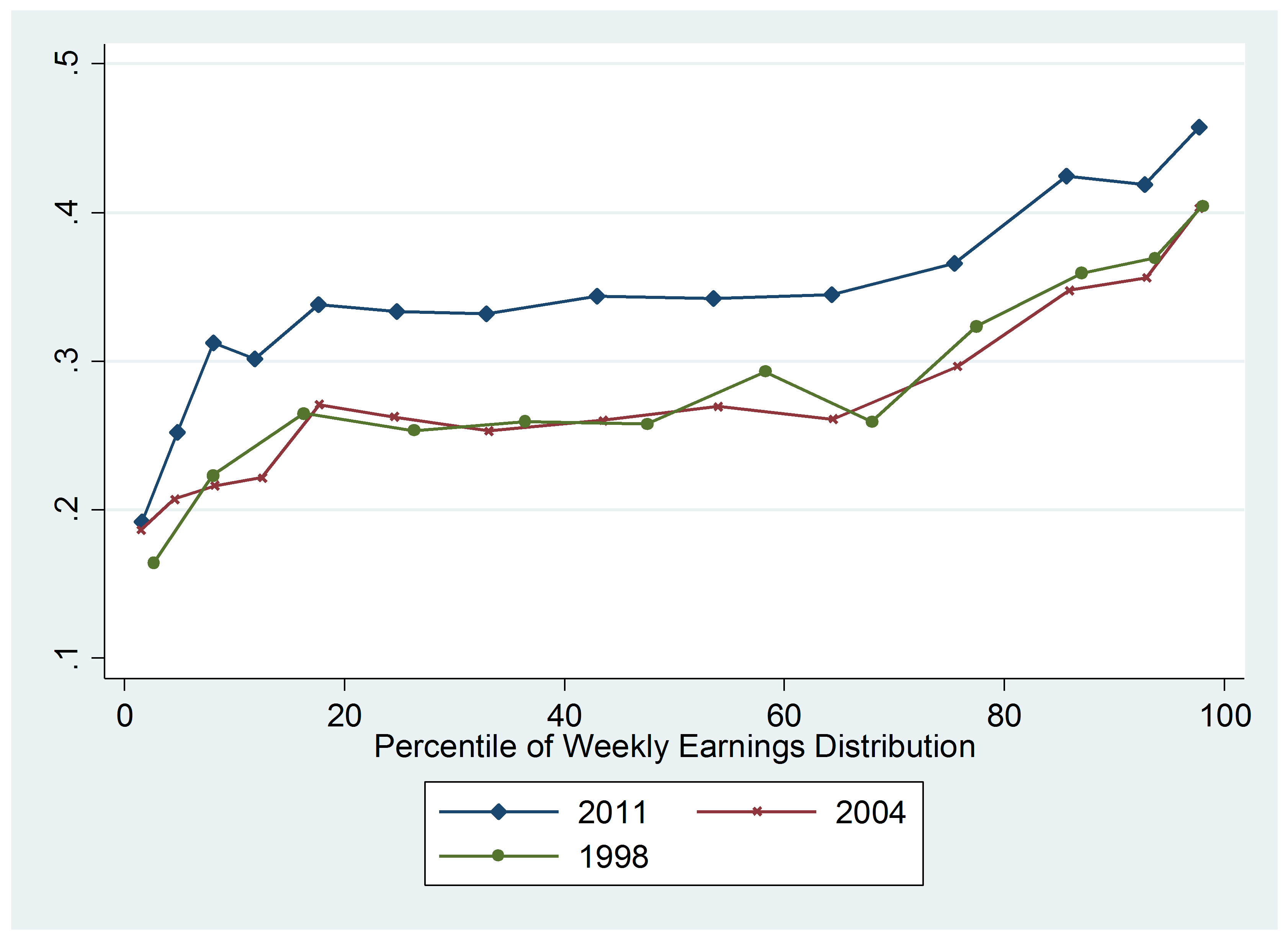

The Top Rate Of Income Tax British Politics And Policy At Lse

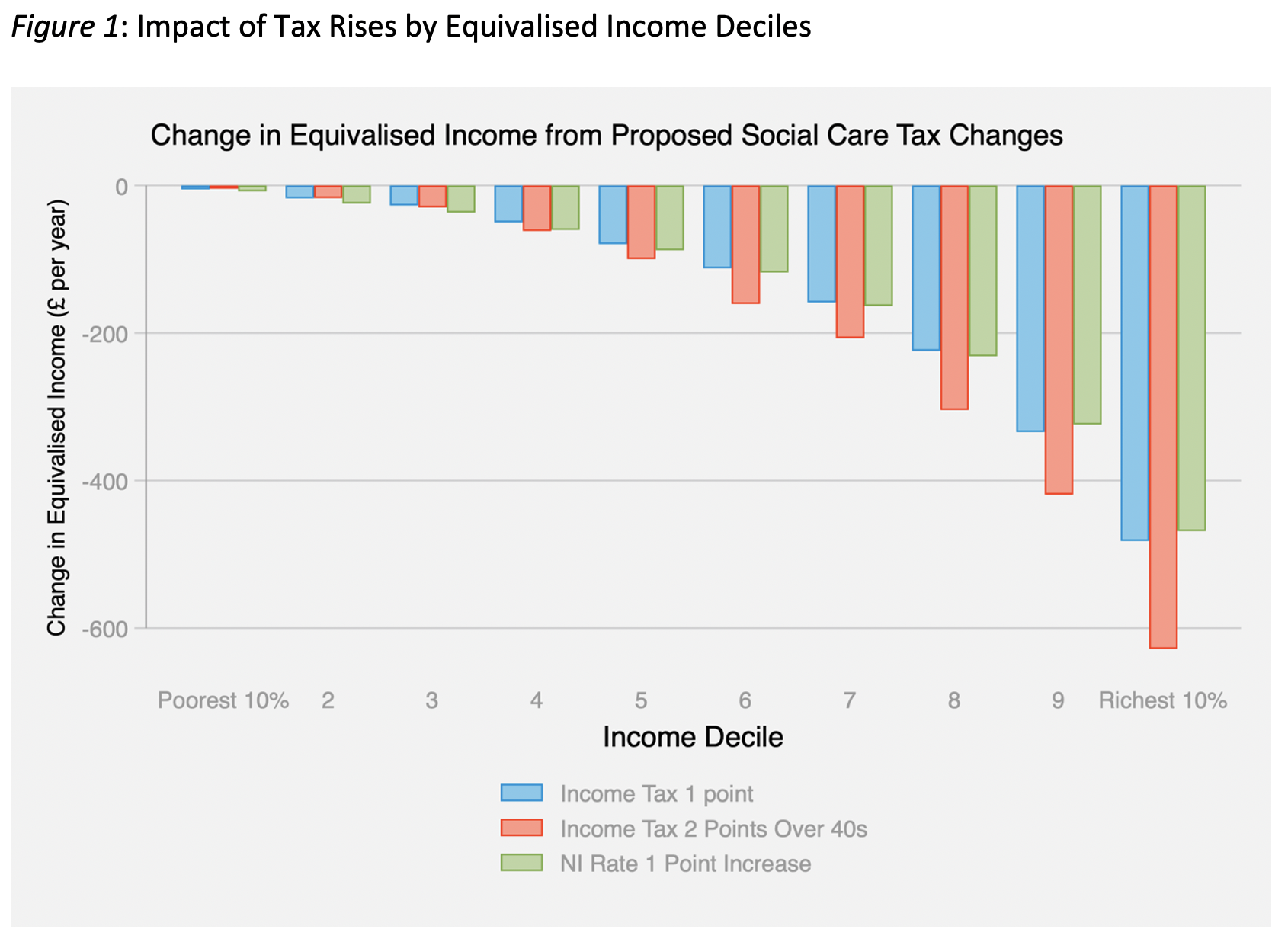

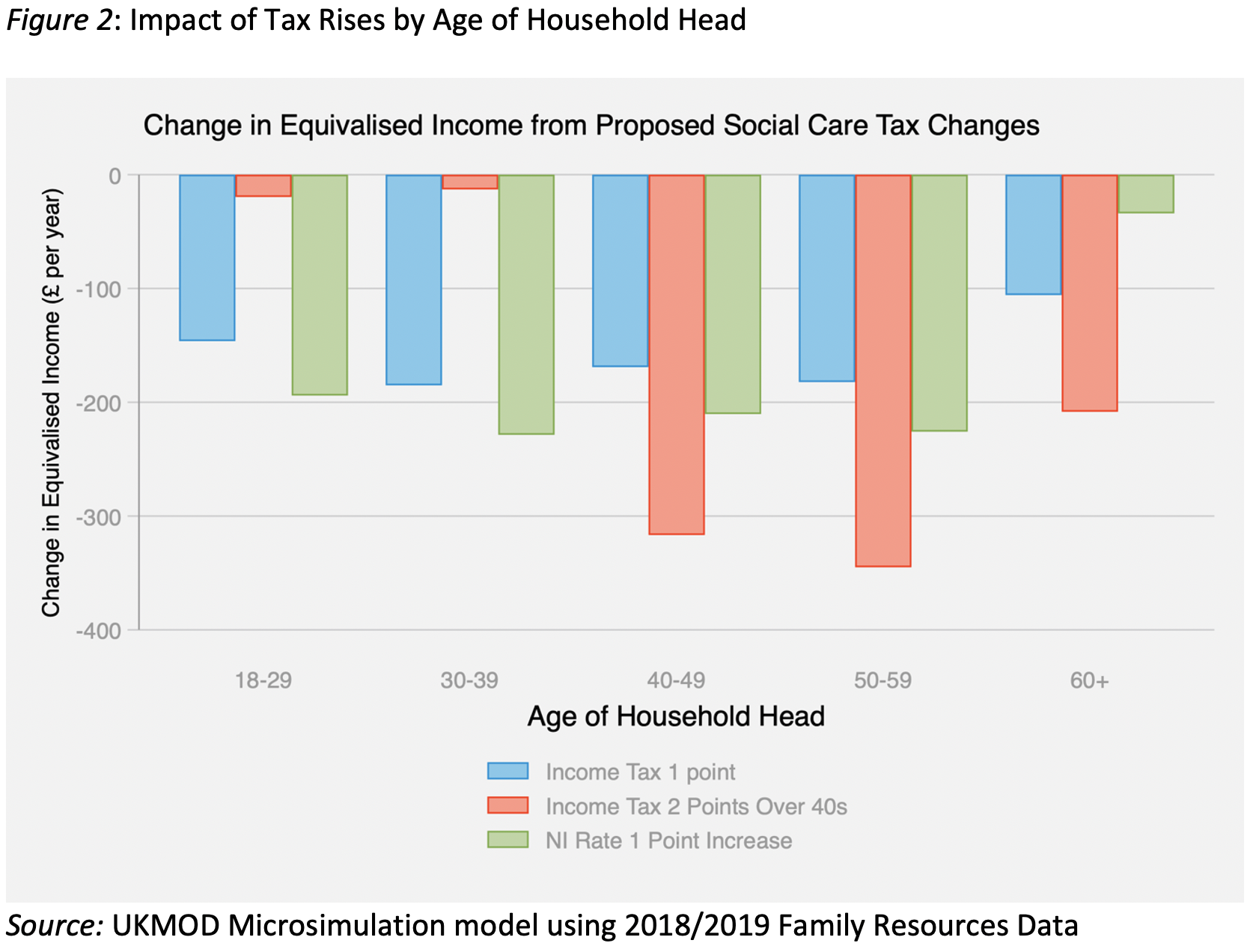

Young People Without Rich Parents Will End Up Paying For A Rise In National Insurance To Fund Social Care British Politics And Policy At Lse

How Do Taxes Affect Income Inequality Tax Policy Center

The Top Rate Of Income Tax British Politics And Policy At Lse

Young People Without Rich Parents Will End Up Paying For A Rise In National Insurance To Fund Social Care British Politics And Policy At Lse

Tax On Test Do Britons Pay More Than Most Tax The Guardian

Boris Johnson And Rishi Sunak Have Announced Tax Rises Worth 2 Of Gdp In Just Two Years The Same As Tony Blair And Gordon Brown Did In Ten Institute For

Types Of Tax In Uk Economics Help

Budget 2020 What Tax Changes Would Be Popular Yougov

Boris Johnson And Rishi Sunak Have Announced Tax Rises Worth 2 Of Gdp In Just Two Years The Same As Tony Blair And Gordon Brown Did In Ten Institute For

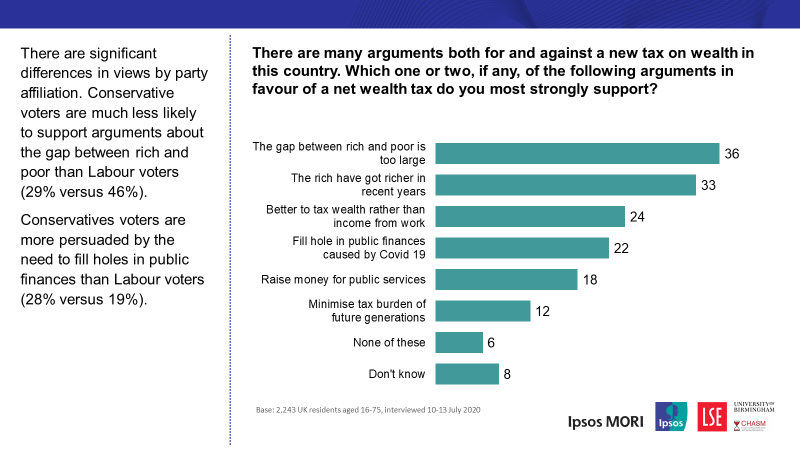

Britons Support Paying More Tax To Fund Public Services Most Popular Being A New Net Wealth Tax Ipsos

Young People Without Rich Parents Will End Up Paying For A Rise In National Insurance To Fund Social Care British Politics And Policy At Lse

Britons Support Paying More Tax To Fund Public Services Most Popular Being A New Net Wealth Tax Ipsos

Budget 2020 What Tax Changes Would Be Popular Yougov

The Top Rate Of Income Tax British Politics And Policy At Lse